Complimentary Alcohol for Customers in Florida: A Legal Guide for Non‑Alcohol Businesses

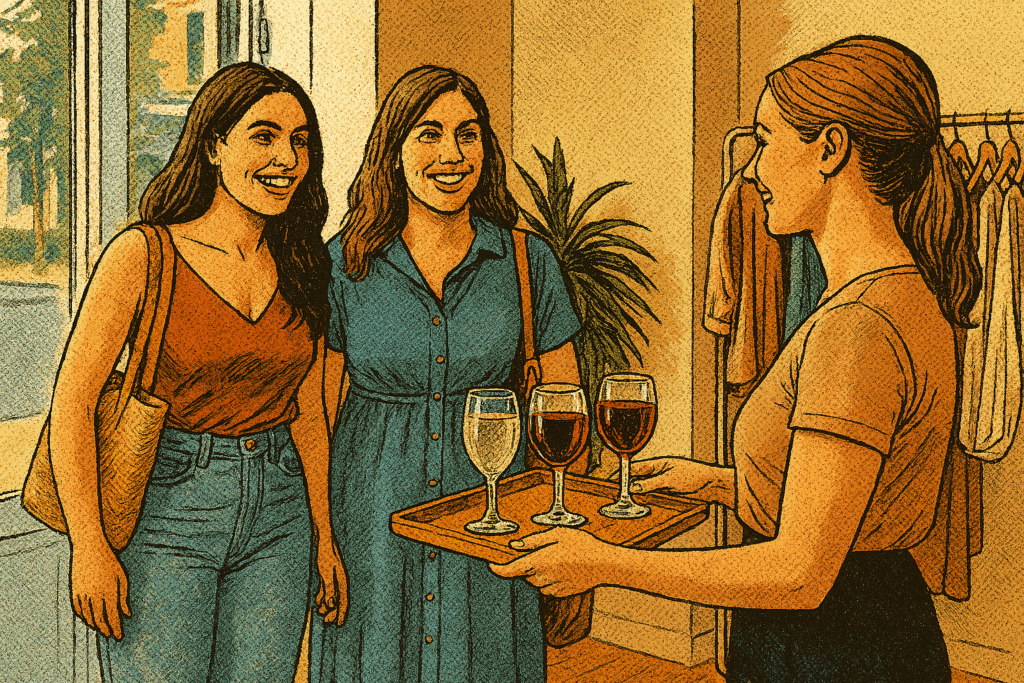

Florida salons, galleries, boutiques, professional offices, and even auto dealerships often ask if they can offer a glass of beer, wine, or bubbly as a courtesy to customers. The short answer: Yes—if it’s truly complimentary and handled carefully.

Below is a practical roadmap grounded in Florida law, with concrete do’s and don’ts to keep your hospitality legal and low‑risk.

The core rule: no license is required if you are not selling alcohol

Florida criminalizes the unlicensed sale of alcoholic beverages. If your business is not selling alcohol and is simply giving it away as hospitality, a state alcohol license is not required. The key is to avoid any fact pattern that turns your “free” drink into a sale. Florida defines “sale” broadly to include a gift of an alcoholic beverage in connection with a paid transaction—so bundling or tying a drink to something the customer pays for can convert hospitality into an unlicensed sale.

Translation: If money changes hands for anything in a way that’s connected to the drink, ABT can view the drink as a sale.

“Keep it non‑sale”: how to serve without triggering a license

Avoid these common traps that create “consideration” and therefore a sale:

- Cover charges, admission fees, or “event tickets” that include access to drinks.

- “Complimentary with purchase” promotions (e.g., “free wine with haircut” or “champagne with any purchase over $50”).

- Drink tokens included in paid swag bags or event packages.

- “Suggested donations” at the drink station, or tip jars in a way that implies payment for the beverage.

- Any minimum purchase requirement tied—explicitly or implicitly—to receiving a drink.

Safer hospitality practices:

- Keep it truly complimentary, no strings attached.

- Offer small pours from a supervised station; provide water and non‑alcoholic options.

- Post a discreet sign: “Complimentary beverages (not for sale). 21+.”

- Retain receipts showing your business purchased the alcohol at retail and provided it free of charge (helpful if ABT ever asks).

Who regulates what: federal, state, and local

Federal (TTB). There is no federal retail license for complimentary service. Federal Alcohol Dealer Registration applies to businesses that sell beverage alcohol. If you’re not selling, that federal registration typically isn’t triggered.

- State (Florida ABT). ABT enforces the Beverage Law. Unlicensed sales are prohibited; maintaining a place where unlawful sales occur carries enhanced penalties. [Florida Statutes Section 562.12]

- Local (city/county). Check ordinances for open‑container rules, special event permits, and occupancy limits. This is especially important if any service occurs outside your storefront or in courtyards/sidewalks.

Insurance: confirm host liquor liability coverage

Ask your broker whether your CGL policy includes host liquor liability—coverage for businesses not in the business of selling alcohol that occasionally serve complimentary drinks. Confirm: (1) employees who pour are covered, (2) coverage applies on your premises and at client receptions, and (3) any third‑party bartender/caterer carries primary liquor liability and names you additional insured.

Florida’s “dram shop” statute generally limits liability for serving adults but creates liability if you willfully and unlawfully serve a minor or knowingly serve someone habitually addicted to alcohol. Your team must card guests who appear under 30 and be prepared to refuse service.

Don’t accept supplier money, product, or staffing (tied‑house rules)

Florida’s tied‑house statute prohibits manufacturers, importers, and distributors from giving “things of value” to retailers. If a supplier “sponsors” your complimentary service with cash, product, or personnel, that can create violations. Buy the product yourself at ordinary retail; suppliers shouldn’t fund or pour.

Want background on tied‑house limits? See our explainer: What is a “Tied House” and Why is it Evil?.

When to get a license (or hire a licensed caterer)

Consider a retail license or a licensed alcohol caterer if:

- You intend to charge admission, tickets, tokens, or any per‑drink fee;

- Alcohol becomes a recurring, promoted part of your business model (e.g., weekly “wine nights”); or

- You want to offer spirits or cocktails beyond occasional small hospitality pours.

For businesses that want a low‑lift path, hiring a licensed caterer (13CT) to handle service—even if you don’t charge—can offload execution and risk. (Caterers are licensed vendors and operate under their own compliance program.)

Practical checklist

- Policy: Adopt a one‑page “Complimentary Beverage Policy” (21+, ID check, refuse service if impaired, no payments/tips for drinks, manager‑on‑duty approval).

- Procurement: Purchase at retail; keep receipts in an “Events/Hospitality” folder.

- Set‑up: Supervised station, small glassware, water/NA options, “complimentary/not for sale” sign.

- Staff brief: Card suspicious ages; no “with purchase” language; no tip jar at the drink station.

- Local check: Confirm open‑container and any event permit needs with your city/county.

- Insurance: Verify host liquor coverage and certificates from any third‑party bartender/caterer.

FAQs

Can we advertise complimentary drinks?

Yes—carefully. Do not advertise “free with purchase.” Safe phrasing is “Hospitality beverages may be available for adult guests (21+). No purchase required. Not for sale.” That signals no consideration and aligns with the “not a sale” position.

May employees accept tips at the beverage station?

Avoid tip jars or tip prompts at the station—they can look like consideration for the drink. If your business normally accepts tips for services (e.g., salon services), handle those at checkout—not at the beverage point.

How much can we pour?

Florida doesn’t set specific pour limits for hospitality in an unlicensed setting, but small pours (e.g., 3–5 oz wine; a single small bottle/can of beer; no mixed spirits) with limits per guest demonstrate responsible service and help defend the “hospitality, not service for sale” posture.

What if a distributor offers to donate product for our event?

Decline. That’s a “thing of value” from a supplier to a retailer and risks tied‑house violations.

Where can I read more about alcohol sampling/tastings rules?

Those programs are for licensed retail premises and look very different from complimentary hospitality at non‑alcohol businesses. For context, see Rules for Alcohol Sample Tastings in Florida.

Do you have any questions about complimentary alcohol for customers? Contact us to schedule a consultation with a beverage attorney.

Because we’re attorneys: Disclaimer. Posted September 30, 2025.